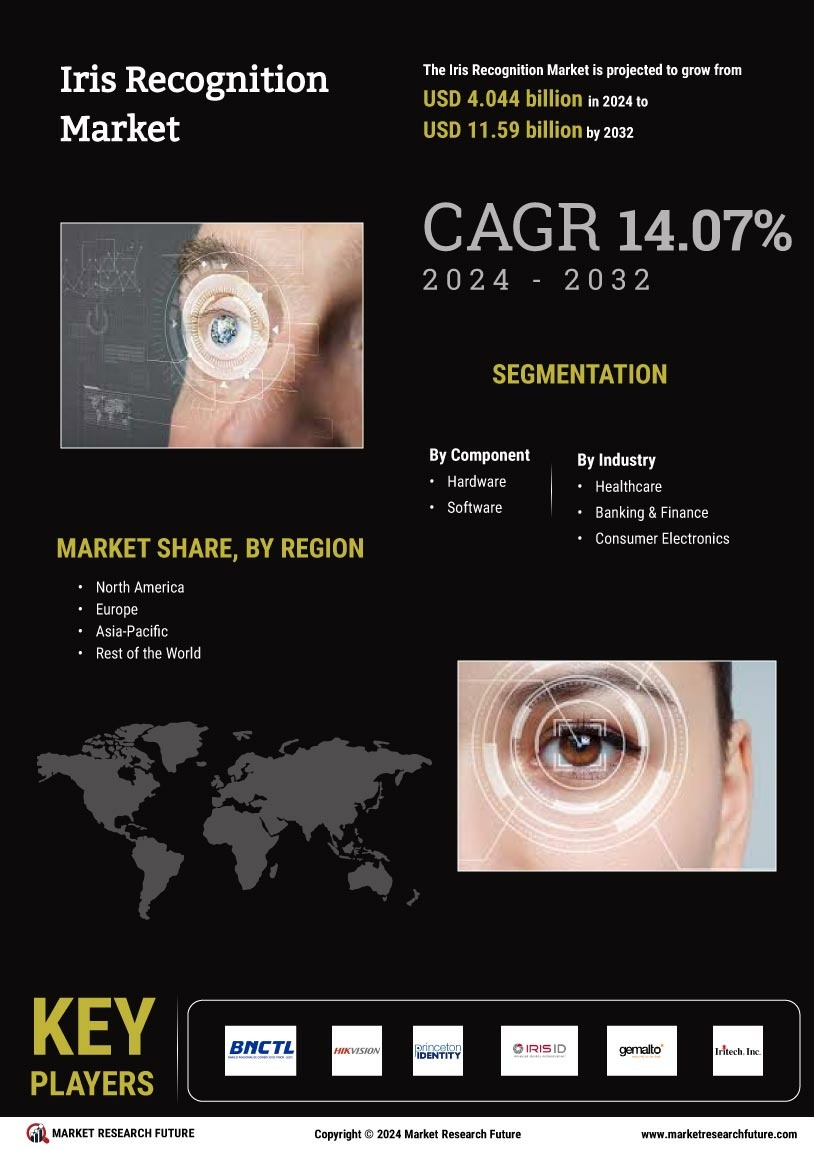

Iris recognition technology is transforming the financial services sector by providing a secure and efficient method for customer identification and access control. The Iris Recognition Market is experiencing significant growth as banks and financial institutions seek to enhance security measures and improve customer experiences. With the rise of digital banking and increasing concerns over fraud, iris recognition offers a reliable solution for verifying identities.

One of the primary applications of iris recognition in financial services is in customer authentication. As online banking becomes more prevalent, the need for secure authentication methods has never been more critical. Traditional methods, such as passwords and security questions, are often vulnerable to hacking and identity theft. In contrast, iris recognition provides a biometric solution that is difficult to replicate, ensuring that only authorized individuals can access their accounts.

Financial institutions are increasingly adopting iris recognition technology at ATMs and branch locations. By integrating iris scanners into their systems, banks can offer customers a seamless and secure way to authenticate their identities. This not only enhances security but also improves the overall customer experience by reducing the need for physical cards or PINs. Customers can simply look into the iris scanner to gain access to their accounts, making transactions faster and more convenient.

Moreover, iris recognition technology can help financial institutions comply with regulatory requirements related to Know Your Customer (KYC) and anti-money laundering (AML) practices. By accurately identifying customers through their unique iris patterns, banks can ensure that they are meeting compliance standards and reducing the risk of fraudulent activities. This is particularly important in an era where regulatory scrutiny is increasing, and financial institutions must demonstrate their commitment to preventing fraud.

The implementation of iris recognition technology also enhances security within financial institutions. With the growing threat of cyberattacks and data breaches, banks must take proactive measures to protect sensitive customer information. By using iris recognition for access control to secure areas, such as data centers and vaults, financial institutions can prevent unauthorized access and safeguard critical data.

Despite the numerous advantages, the adoption of iris recognition technology in financial services is not without challenges. Privacy concerns are a significant issue, as customers may be apprehensive about their biometric data being collected and stored. Financial institutions must address these concerns by being transparent about how biometric data will be used and implementing strong data protection measures. Building trust with customers is essential for the successful implementation of iris recognition systems.

Additionally, the cost of implementing iris recognition technology can be a barrier for some financial institutions, particularly smaller banks and credit unions. However, as technology advances and becomes more affordable, it is likely that more institutions will adopt iris recognition as a standard practice for customer authentication.

Looking to the future, the potential for iris recognition technology in financial services is vast. As the technology continues to evolve, we can expect further enhancements in accuracy and efficiency. Innovations such as mobile iris recognition applications will allow customers to authenticate their identities from their devices, providing even greater convenience and security.

Furthermore, the integration of iris recognition with other biometric modalities, such as fingerprint recognition and facial recognition, can create a comprehensive security framework for financial institutions. This multi-modal approach can enhance overall security and provide customers with a seamless experience across various platforms.

In conclusion, iris recognition technology is poised to play a crucial role in the financial services sector by enhancing security, improving customer experiences, and ensuring compliance with regulatory requirements. As the iris recognition market continues to grow, financial institutions that embrace this technology will be better equipped to address the challenges of a rapidly changing landscape and provide secure, efficient services to their customers.@https://www.marketresearchfuture.com/reports/iris-recognition-market-2430

One of the primary applications of iris recognition in financial services is in customer authentication. As online banking becomes more prevalent, the need for secure authentication methods has never been more critical. Traditional methods, such as passwords and security questions, are often vulnerable to hacking and identity theft. In contrast, iris recognition provides a biometric solution that is difficult to replicate, ensuring that only authorized individuals can access their accounts.

Financial institutions are increasingly adopting iris recognition technology at ATMs and branch locations. By integrating iris scanners into their systems, banks can offer customers a seamless and secure way to authenticate their identities. This not only enhances security but also improves the overall customer experience by reducing the need for physical cards or PINs. Customers can simply look into the iris scanner to gain access to their accounts, making transactions faster and more convenient.

Moreover, iris recognition technology can help financial institutions comply with regulatory requirements related to Know Your Customer (KYC) and anti-money laundering (AML) practices. By accurately identifying customers through their unique iris patterns, banks can ensure that they are meeting compliance standards and reducing the risk of fraudulent activities. This is particularly important in an era where regulatory scrutiny is increasing, and financial institutions must demonstrate their commitment to preventing fraud.

The implementation of iris recognition technology also enhances security within financial institutions. With the growing threat of cyberattacks and data breaches, banks must take proactive measures to protect sensitive customer information. By using iris recognition for access control to secure areas, such as data centers and vaults, financial institutions can prevent unauthorized access and safeguard critical data.

Despite the numerous advantages, the adoption of iris recognition technology in financial services is not without challenges. Privacy concerns are a significant issue, as customers may be apprehensive about their biometric data being collected and stored. Financial institutions must address these concerns by being transparent about how biometric data will be used and implementing strong data protection measures. Building trust with customers is essential for the successful implementation of iris recognition systems.

Additionally, the cost of implementing iris recognition technology can be a barrier for some financial institutions, particularly smaller banks and credit unions. However, as technology advances and becomes more affordable, it is likely that more institutions will adopt iris recognition as a standard practice for customer authentication.

Looking to the future, the potential for iris recognition technology in financial services is vast. As the technology continues to evolve, we can expect further enhancements in accuracy and efficiency. Innovations such as mobile iris recognition applications will allow customers to authenticate their identities from their devices, providing even greater convenience and security.

Furthermore, the integration of iris recognition with other biometric modalities, such as fingerprint recognition and facial recognition, can create a comprehensive security framework for financial institutions. This multi-modal approach can enhance overall security and provide customers with a seamless experience across various platforms.

In conclusion, iris recognition technology is poised to play a crucial role in the financial services sector by enhancing security, improving customer experiences, and ensuring compliance with regulatory requirements. As the iris recognition market continues to grow, financial institutions that embrace this technology will be better equipped to address the challenges of a rapidly changing landscape and provide secure, efficient services to their customers.@https://www.marketresearchfuture.com/reports/iris-recognition-market-2430

Iris recognition technology is transforming the financial services sector by providing a secure and efficient method for customer identification and access control. The Iris Recognition Market is experiencing significant growth as banks and financial institutions seek to enhance security measures and improve customer experiences. With the rise of digital banking and increasing concerns over fraud, iris recognition offers a reliable solution for verifying identities.

One of the primary applications of iris recognition in financial services is in customer authentication. As online banking becomes more prevalent, the need for secure authentication methods has never been more critical. Traditional methods, such as passwords and security questions, are often vulnerable to hacking and identity theft. In contrast, iris recognition provides a biometric solution that is difficult to replicate, ensuring that only authorized individuals can access their accounts.

Financial institutions are increasingly adopting iris recognition technology at ATMs and branch locations. By integrating iris scanners into their systems, banks can offer customers a seamless and secure way to authenticate their identities. This not only enhances security but also improves the overall customer experience by reducing the need for physical cards or PINs. Customers can simply look into the iris scanner to gain access to their accounts, making transactions faster and more convenient.

Moreover, iris recognition technology can help financial institutions comply with regulatory requirements related to Know Your Customer (KYC) and anti-money laundering (AML) practices. By accurately identifying customers through their unique iris patterns, banks can ensure that they are meeting compliance standards and reducing the risk of fraudulent activities. This is particularly important in an era where regulatory scrutiny is increasing, and financial institutions must demonstrate their commitment to preventing fraud.

The implementation of iris recognition technology also enhances security within financial institutions. With the growing threat of cyberattacks and data breaches, banks must take proactive measures to protect sensitive customer information. By using iris recognition for access control to secure areas, such as data centers and vaults, financial institutions can prevent unauthorized access and safeguard critical data.

Despite the numerous advantages, the adoption of iris recognition technology in financial services is not without challenges. Privacy concerns are a significant issue, as customers may be apprehensive about their biometric data being collected and stored. Financial institutions must address these concerns by being transparent about how biometric data will be used and implementing strong data protection measures. Building trust with customers is essential for the successful implementation of iris recognition systems.

Additionally, the cost of implementing iris recognition technology can be a barrier for some financial institutions, particularly smaller banks and credit unions. However, as technology advances and becomes more affordable, it is likely that more institutions will adopt iris recognition as a standard practice for customer authentication.

Looking to the future, the potential for iris recognition technology in financial services is vast. As the technology continues to evolve, we can expect further enhancements in accuracy and efficiency. Innovations such as mobile iris recognition applications will allow customers to authenticate their identities from their devices, providing even greater convenience and security.

Furthermore, the integration of iris recognition with other biometric modalities, such as fingerprint recognition and facial recognition, can create a comprehensive security framework for financial institutions. This multi-modal approach can enhance overall security and provide customers with a seamless experience across various platforms.

In conclusion, iris recognition technology is poised to play a crucial role in the financial services sector by enhancing security, improving customer experiences, and ensuring compliance with regulatory requirements. As the iris recognition market continues to grow, financial institutions that embrace this technology will be better equipped to address the challenges of a rapidly changing landscape and provide secure, efficient services to their customers.@https://www.marketresearchfuture.com/reports/iris-recognition-market-2430

·945 Views